What is Truth-in-Taxation? How do property taxes work? Who collects the money? How are we supposed to learn about that?

Nathan S., a homeowner in Utah County, and Jessica Weaver, a renter in Morgan County, both say the same thing: ‘We don’t have time to pay attention.’

“For me, and this is true of most politics, I feel a little disempowered,” Nathan said. “There is little I could do to make a difference unless I devoted my whole life to thinking about it and working in that area. In other words, I feel that the ratio of benefit to time and cost required just isn’t worth it for me.”

“I feel like the system is working as it was sculpted to,” Jessica said. “After a long day of cultivating a family, a home, and doing all I can to maintain my mental and physical health and make sure we are on top of taxes and following all the requirements for staying alive and in legal standing with the local and federal governments, I don’t have the time, money, or energy to invest in change. I’m just trying to make ends meet and provide a pleasant experience of life for the people I love.”

Many homeowners probably don’t know how taxes work, and they may not know that they have any control over them.

Malorie Lauket, a homeowner in Salt Lake County said, “I don’t know what Truth-in-Taxation is. And I don’t pay attention. I care, but I try to trust the people whose job it is to do their best. And if something comes up that doesn’t make sense, I will research the topic and contact someone if necessary.”

Most people don’t have time to pay attention to the issue, even if they wanted to follow the local government action more closely.

The next question is, why do they seem to go up so much when there is so much growth in the state of Utah, especially in Utah, Salt Lake and Davis Counties? If there are more people paying property taxes, shouldn’t that mean that people who were already here shouldn’t have to pay more?

Fortunately, and unfortunately, it isn’t that simple.

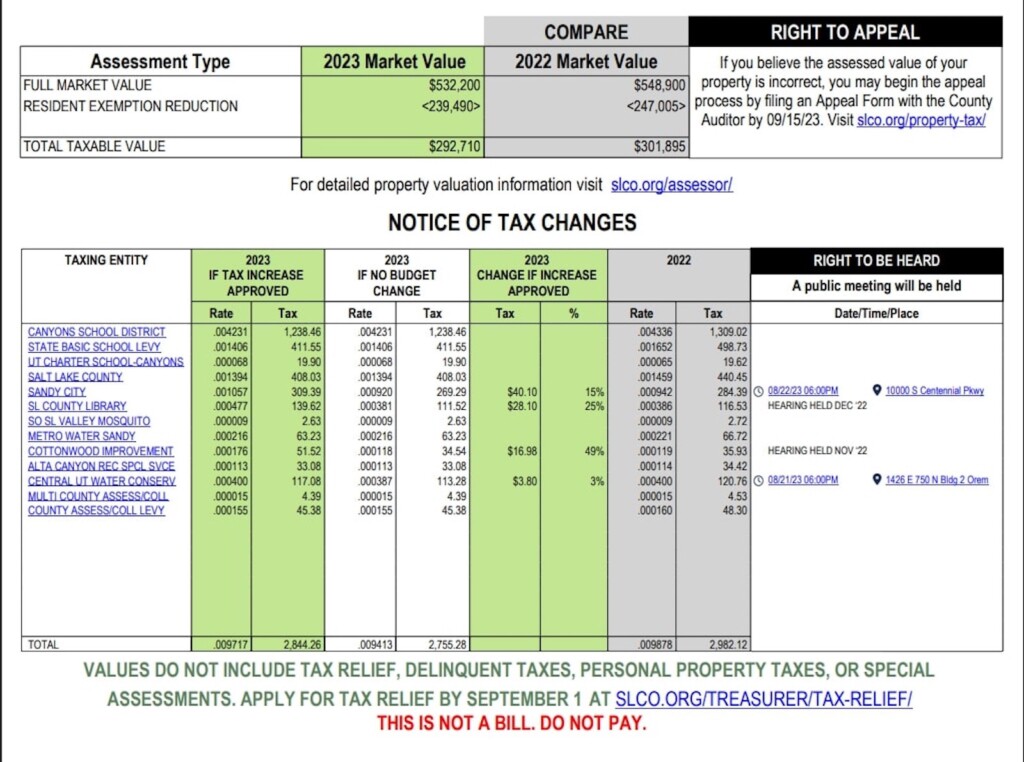

Property taxes are collected by a lot of different places, called ‘taxing entities.’ City or town governments collect taxes from their residents, but there are other borders that all properties are separated into. It’s not uncommon for residents to flock to city council meetings when they think their taxes are too high, but the city only collects a small portion; the bigger portion probably goes to the school districts. Your county gets some of it, as well as water districts, mosquito abatements and library systems. Every entity that gets your property tax dollars is listed on your yearly tax statement.

“I think Truth-in-Taxation means we know what our taxes are being spent on and that the government has to make that information available to the public,” says taxpayer Crystal Leonard. “But I don’t even know if that’s correct.”

This isn’t entirely wrong, it is true that all budgets and spending must be publicly available in Utah. Truth-in-Taxation specifically refers to meetings that are held every August if a taxing entity wants to make a change. The county government is in charge of setting all the meeting times so residents have a chance to go to all of the meetings if they wish, and no meetings will overlap. Salt Lake County will hold their meeting on August 22, 2023 at 6pm

Truth-in-Taxation meetings are only held if the entity wants to change the rate/percentage of money they collect from their residents.

Property values change every year. In the recent past, Utah home values have skyrocketed at an alarming and uncomfortable pace. But, an increase in the value of your home does not guarantee an increase in your tax bill.

The county government is in charge of determining the tax rate. Every year, a taxing entity will receive the same dollar amount from all the properties in their area. Property owners have a safeguard against the rising and falling values, and cities have a safeguard that they can count on the same income from year to year. Because of this, the rate or percentage of home value that is taxed changes every year. If the property values rise, the percentage of your value that you pay will decrease. If the property values fall, the percentage of the value you pay will increase.

At this point, you may think to yourself that this has to be wrong, because your tax bill does change every year.

Remember how entities collect the same amount of money every year? That money comes from a combined payment from all the properties, commercial and residential, but commercial and residential property values change at different rates. The past few years have been an excellent example of commercial property values decreasing because so many office workers stayed at home to perform their jobs. Because the commercial rates decreased, the residential owners now carry a bigger part of the bill.

There are a lot of numbers working in the background that are not obvious to residents. What is plain is when an entity wants to change the rate that the county set for a particular year.

For example, West Jordan performed the Truth-in-Taxation process in 2021. In 2020, their tax rate was 0.1899%. The county then set the new rate for 2021 at 0.1732%. The council raised this year’s rate by 3.2% and properties will now pay 0.1788%. A tax increase is a percentage increase on the rate that is set for that year.

Talking about tax increases by percentages can be very misleading. A percentage increase is not on the amount that you pay on your tax bill. It is an increase on the percentage the county set for that particular year.

If you want to know what is going on with your taxes, the best place to look is your property tax bill. It will tell you what the rates are for the current year. It will also tell you if there are any Truth-in-Taxation meetings, and when, where and what the proposed increase is. All these meetings are public and allow time for residents to voice their opinions.

Property taxes are complicated and can be very confusing, which can cause a lot of distress and distrust in government. The best way to learn about how your taxes work is to contact your local county assessor and ask as many questions as you can. They can explain your property tax bill, who gets what money, and how to contact any of the taxing entities in your area.