Opponents of a tax reform bill that was approved by the Utah Legislature and signed into law by Governor Gary Herbert hoped to repeal the legislation at the polls this November.

Instead, they won the fight without a single vote from the public. The governor and legislative leaders threw in the towel after organizers of the Tax Restructuring Revisions Referendum campaign said they had submitted enough signatures on Jan. 21—nearly 145,000, more than the minimum 115,689 needed to let citizens decide the law’s fate.

Herbert, Senate President J. Stuart Adams, and Speaker of the House Brad Wilson issued a statement January 23 saying a bill would be introduced to repeal the changes made to the tax code by Senate Bill 2001, which had been approved during a special session. Five days later, the legislature approved the measure and the governor signed it.

“We will take time to reset and address this issue in the future in a way that allows all Utahns to fully understand the challenge we face, engage in the debate over the best solutions and, ultimately, enact policy that best positions Utah for decades to come,” the statement says.

Gina Cornia, executive director of Utahns Against Hunger, which supported the referendum, said the success of the signature drive was exciting.

“People were feeling like their voices weren’t being heard,” she said of the tax bill opponents.

The now-repealed changes included sales tax increases on food, fuel and services such as ride-sharing services and music and video streaming. (Many of the services originally in the bill were removed before its passage, including those by doctors and lawyers.) The measure also had an income tax reduction, which some worried would hurt public education, which is funded by those taxes.

The Sutherland Institute, a Salt Lake City think tank, launched an information campaign about the bill and said the tax cut would increase funding available to public schools. The Utah Taxpayers Association said in a news release that the income tax cuts, along with a higher dependent deduction amount and grocery tax credits, would far outweigh the food sales tax increases.

The Association’s release urged Utahns to “learn the truth before being duped into believing all of the myths, misunderstandings and falsehoods about this landmark legislation.”

Cornia rejects the argument that the income tax decrease would benefit Utahns who live on the fringe, saying a refund at the end of the year would not help them with their month-to-month expenses. “People think the basic necessities should not be taxed,” she said.

The referendum got a boost when Harmons grocery store chain came out against the food tax increase and allowed volunteers to collect signatures at its locations.

On January 20, the day before the deadline to submit referendum petitions, signature gatherers were out in force. Christine Calder, who was stationed at the Harmons at Brickyard, 3270 S 1300 E, said most people already knew about the referendum effort and wanted to sign.

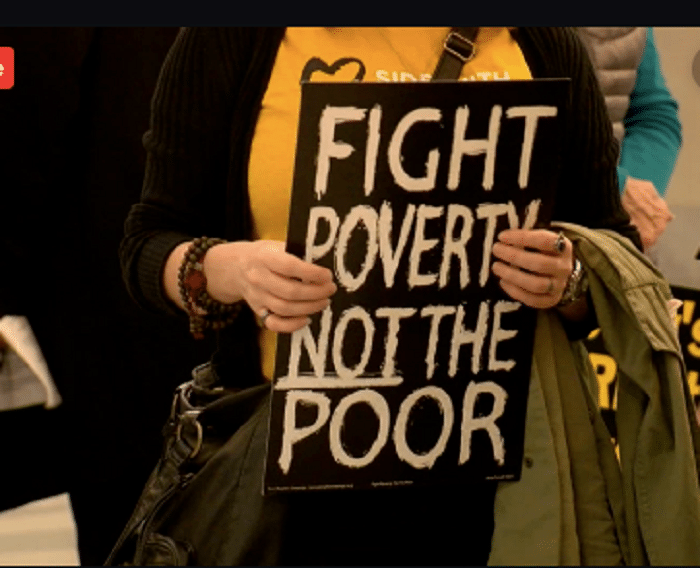

Many of the signers were concerned about the tax increase on food, including Susan Madsen, who said she objected to it because so many people are struggling financially, and Linda Saxton, who described it as a tax on the poor. Others said they were tired of not having their voices heard on important issues.

Fred Cox, a former state representative who headed a bipartisan group that started the referendum process, was not surprised by the negative reaction to the changes. He had called his most liberal friends and his most conservative friends and no one liked the bill, he said.

“We exceeded everyone’s expectations and showed the legislature that what they proposed didn’t go over so well,” said Cox, a conservative Republican. “There was something in there that everyone hated.”

Cox says the state has a surplus and there is no need for legislators to add any taxes.

“With the repeal,” he said, “I’m hopeful they’re listening.”