Like Oliver Twist seeking more porridge, giant corporations are going to communities with their bowls out asking for more. But unlike Oliver, they usually get exactly what they want from city leaders.

“Rent seeking” is conducted with the best of intentions: they want to help ensure profits for shareholders by asking communities for welfare for “tax abatements”. These abatements are deferred taxes, usually in the form of property or sales taxes, which allow corporations to not pay nearly as much in taxes as their smaller neighbors pay. They receive the deals with the promise of providing “high-paying jobs to communities.”

Receivers of the largest tax abatements in Utah are the largest corporate retailers: Walmart, Home Depot, Costco, Lowes, Scheels, Cabelas and most recently, Amazon. From a political leader’s perspective, these abatements produce a win/win. Cities need jobs and tax revenue, and corporations need revenue for their investors. Win/win, right?

It turns out that land is a scarce resource with potential alternative uses. Putting big-box parks throughout our suburban areas, as it turns out, isn’t such a great investment per acre after all.

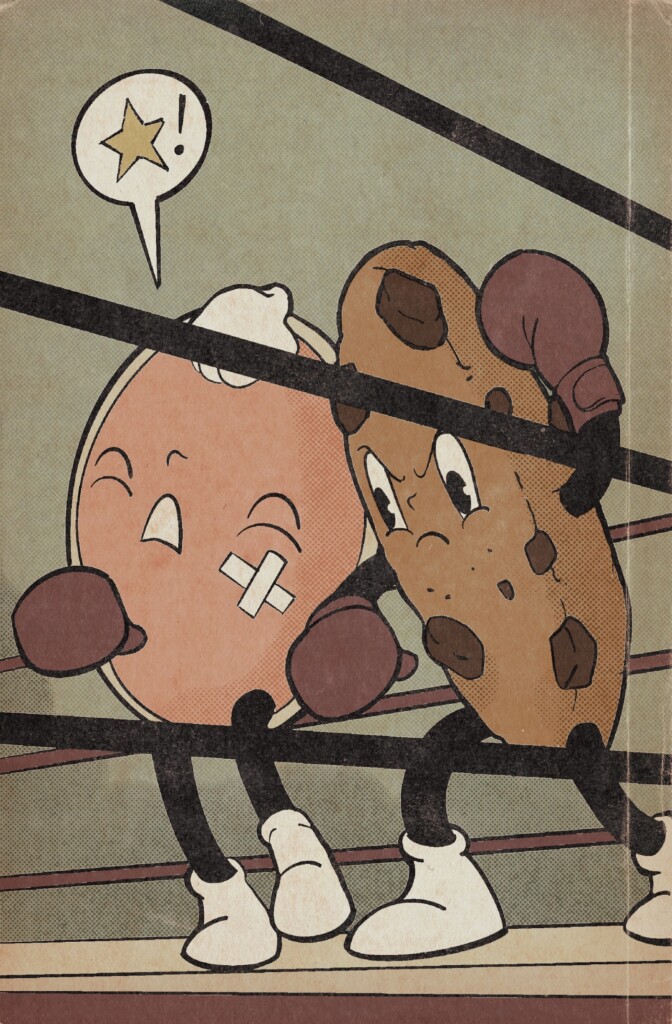

Compare a big box to building mixed-use developments (which includes both housing and retail shopping). The revenue that big-box stores provide back to cities doesn’t even come close to what local businesses offer, as one of our stories delves into in this issue. And as most readers already know, local businesses recirculate seven times more money in the local economy than big-box retailers.

The measure of the effectiveness of big-box stores is clearly demonstrated by the whereabouts of the Spirit Halloween stores each October. Spirit occupies empty big-box stores. These empty stores are the result of city leaders giving corporate welfare to big-box retailers that resulted in failure. Spirit makes a deal to occupy this cheap retail space for two months, which offers a pittance in tax sales revenue back to cities.

The empty spaces are too large for any local businesses to occupy, so it then becomes the cities who go around with empty bowls, like Oliver, seeking the porridge from their corporate benefactors: “Please sir, we need some more!” And cities or retail shopping owners offer ever-greater incentives to encourage them to invest. Just as Sandy City did to entice Walmart to build a super-center in what was slated to be a city park at Quarry Bend. Thanks Tom Dolan.

Compare this failed model to older areas with smaller retail areas specifically designed for locally-owned businesses (before modern zoning laws required parking spaces).

Located in Sugar House on the east side of Highland Drive and 2100 East, there are seven locally-owned businesses (Sterling Furniture, Fankhauser Jewelry, Urban Blues, Brittany Jewelry, Raunch Records, Sugar House Frame and All About Coins). Above these shops are affordable apartments. Salt Lake City doesn’t depend on the sales tax revenue of each one of these businesses to a great extent, but they receive far more sales tax revenue and property tax revenue from this single half block complex than any big-box store. So why not instead favor local businesses and mixed use over big boxes?

It’s likely because big box chains appear “too big to fail.” And to be fair, corporate chains have a lower rate of failure than local businesses. This is because, simply put, corporate chains have rigged the system. They receive all sorts of benefits that local businesses don’t enjoy. Besides tax abatements and subsidies, they receive huge rent breaks in malls such as the City Creek Center.

Taubman Centers is the national mall owner that manages the City Creek Center. Utah Stories learned that the Apple Store received a deal to have their first year of rent free at City Creek and pay just 2% of net sales to Taubman in rent.

This deal resulted in Apple being lured away from the Gateway mall to relocate in City Creek. This move decimated the viability of the north end of the Gateway and also ruined the viability of the smaller businesses that were once there. Today, the north end of Gateway is almost empty.

But what impact do these retail wars and the big favors have on locally-owned businesses?

By maintaining a rigged system that favors the big over the small, we get the lousy shopping experiences. Rather than comfortable, unique, local experiences, we get communities filled with big-box store workers, some of which are great, but some of which are clearly counting the minutes till their shift ends and retirement beckons.

Rarely do you see this unhappiness and high job turnover in successful locally-owned shops. Stepping into Fankhauser, or Sterling, All About Coins or Tabula Rasa, we always find great staff, conversation and a connection that could never exist in a mall chain or big-box store.

But besides just being a sound investment for cities wishing to gain the most consistent tax revenue they can receive, betting on local provides connections for residents to gain a sense of ownership in authentic community and people who provide and build the local social fabric.

Write to your city leaders and insist they invest in locally-owned businesses. Shift your spending to local and vote with your dollars to ensure their continued existence.

RELATED CONTENT

Are Small Local Shops Competing with Amazon this Holiday Season?

Local and Mixed-Use Superior to Corporate Big Box Zoning

Walmart-Style Inventory System at Utah Liquor Stores Squashing Local Distilleries

Localism vs. Globalism: Utah Companies Bill Gates put out of Business

SUPPORT LOCAL JOURNALISM AND SUBSCRIBE TO PRINT MAGAZINE